Achi news desk-

Technology stocks have a reputation for providing consistent and substantial returns over the long term, proven by the Nasdaq-100 A 395% increase in the Technology Sector over the last 10 years.

The growing nature of the industry is driven by reliable demand for upgrades to various hardware and software products. So, it’s no surprise that holdings mogul Warren Buffett invests, Berkshire Hathaway, has devoted more than 40% of its portfolio to technology stocks. Berkshire’s holdings, meanwhile, posted a compound annual increase of nearly 20% between 1965 and 2023.

As a result, it could be worth following suit and making a significant long-term investment in the high growth sector. So, here are three stocks to invest $30,000 in right now – $10,000 each.

1. Advanced Micro Devices

Advanced Micro Devices (NASDAQ: AMD) business has exploded over the last decade, taking a leading role in the chip market.

A decade ago, the company was on the brink of bankruptcy, bleeding money alongside mounting debt. Then, in 2014, Lisa Su became the CEO of AMD, triggering one of the most impressive changes in the history of the technology market.

The launch of its Ryzen line of central processing units (CPUs) in 2017 has been a major growth catalyst, with AMD’s CPU market share rising from 18% in the first quarter of 2017 to 33% in 2024. The company has broken away at gradually. Intel‘s share, which fell from 82% to 64% in the same period.

Shares in AMD have increased by 3,500% over the past 10 years. As a result, a $10,000 investment in AMD stock in 2014 would be worth more than $357 billion today.

Of course, past growth does not always indicate what is to come. However, the company has exciting prospects that could deliver big returns over the next 10 years. AMD is investing heavily in artificial intelligence (AI), launching new AI graphics processing units (GPUs) this year and investing in AI PCs.

The AI market reached nearly $200 billion last year and is predicted to reach nearly $2 trillion by 2030. Alongside jobs in other areas of technology, such as cloud computing, video games, and consumer PCs, AMD is likely o continue to benefit from the technology tailwinds for years.

As a result, a $10,000 investment in AMD stock over the next decade could yield significant returns.

2. Amazon

It is impossible to deny Amazon‘s (NASDAQ: AMZN) a strong role in technology. Thanks to its popular e-commerce website, the company has built immense brand loyalty around the world. Amazon’s retail site is available in over 20 countries and ships to more than 100 countries.

The success of Amazon’s e-commerce business has seen annual revenue increase by 546% since 2014, with operating income increasing by more than 20,000%.

Amazon’s meteoric rise is largely due to its lucrative Prime membership. Its subscription-based model bundles multiple services, including free express shipping on its retail site, streaming video, music, games, and more. Including multiple services makes users less likely to unsubscribe, resulting in a global subscriber count of over 230 million.

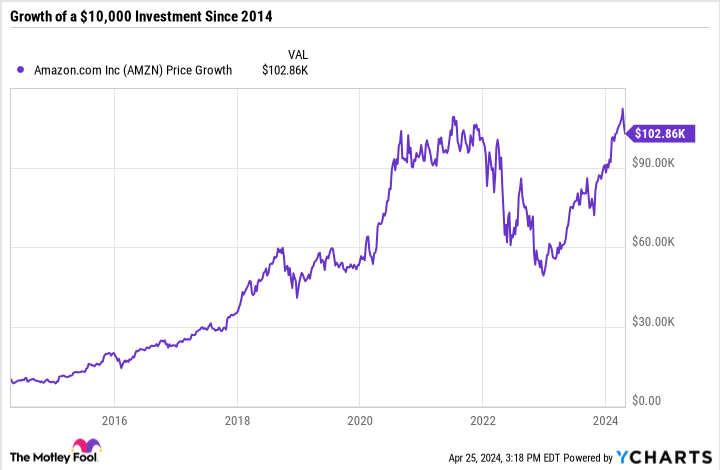

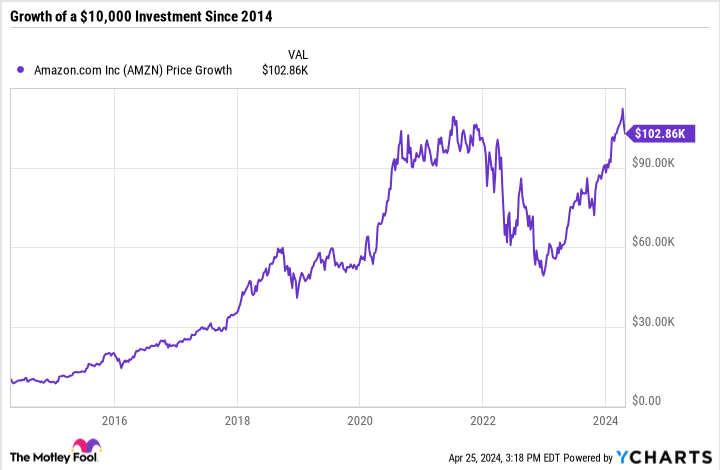

Shares in Amazon have risen 926% since 2014, meaning a $10,000 investment back then would be worth over $102,000 today. And the company could potentially beat that growth over the next 10 years.

In addition to steady retail growth, Amazon is expanding rapidly in AI and cloud computing. On April 25, the company announced plans to invest $11 billion to build data centers in Indiana to grow Amazon Web Services (AWS).

The company is on a promising growth path, and if you have the means, it could be worth a $10,000 investment this month. However, a smaller investment is still worth considering.

3. Apple

An apple (NASDAQ: AAPL) easily one of the most successful companies in the history of technology. Its market cap of $2.6 billion makes it the second most valuable company in the world (only after Microsoft). Meanwhile, Apple’s vast and loyal user base has allowed it to achieve leading market shares in multiple product categories.

However, the company has stumbled over the past year. Macroeconomic headwinds led to repeated quarterly revenue declines in 2023. Apple’s Q1 2024 appeared to break the streak, with revenue rising 2% year over year.

Meanwhile, the tech giant’s free cash flow hit $107 billion, significantly more than Microsoft, Amazon, or Alphabet. The significant difference could suggest that Apple is in the best position to continue investing in its business and make a strong comeback in the coming years.

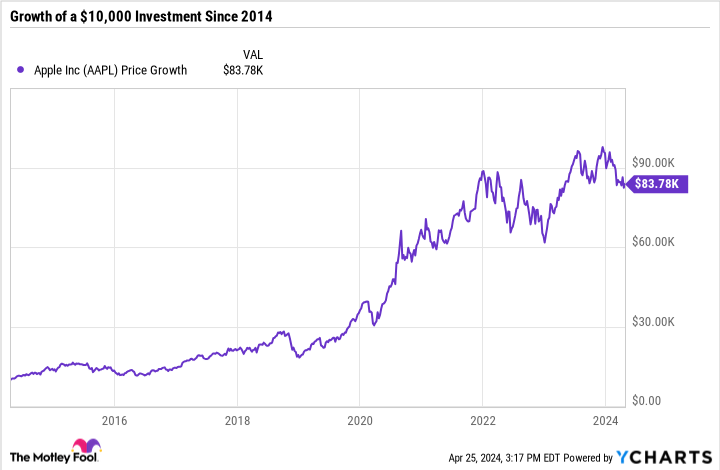

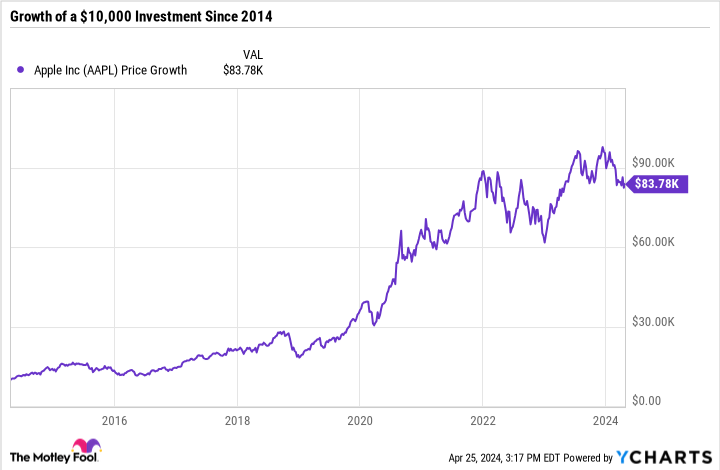

Apple stock is up 738% over the past decade. As a result, a $10,000 investment in its shares 10 years ago would be worth almost $84,000 today.

Moreover, like AMD and Amazon, Apple is taking AI head-on. Over the past year, the company has gradually added AI-driven features across its range of products, with plans to overhaul its MacBook lineup to focus on AI. The company recently acquired French AI company Datakalab, which specializes in on-device processing.

Apple’s leading role in technology and exciting prospects could make it worth investing $10,000 in its stock, with plans to hold it for at least a decade.

Should you invest $1,000 in Micro Advanced Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor a team of analysts just noted what they believe is the top 10 stocks for investors to buy now… and Advanced Micro Devices was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $537,557!*

Stock Advisor gives investors an easy-to-follow blueprint for success, including guidance on portfolio construction, regular analyst updates, and two new stock picks every month. The Stock Advisor service has more than four S&P 500 return since 2002*.

See the 10 stocks »

*The Stock Advisor returns from April 22, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has posts at and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, and Microsoft. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

3 Stocks to Invest $30,000 in Right Now was originally published by The Motley Fool

Source link

Related