Achi news desk-

- Indian news

- Business

- Fixed Deposit (FD) interest April 2024; IDBI Federal Bank of India | Important updates

New Delhi3 hours ago

- Copy link

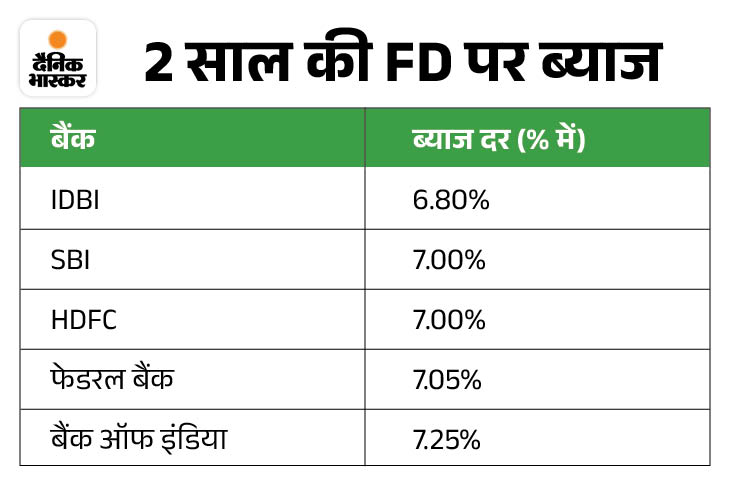

Many major banks including IDBI, Bank of India (BOI) and the Federal Reserve Bank have recently hiked interest rates on fixed deposits (FD). If you are planning to get an FD these days, then you must know about the new interest rates of the banks before that.

We tell you how much interest is given by which bank on FD less than 2 million rupees. So you can invest in the right place according to your convenience. See here where FD will be more beneficial after the change in interest rates.

Tax is also payable on the interest received from FD

The interest received from FD is fully taxable. Any interest you earn on FD in a year is added to your annual income. Based on your total income, your tax schedule is determined. Since interest income earned on FD is considered “income from other sources”, it is chargeable under Tax Deducted at Source or TDS. When your bank deposits your interest income in your account, TDS is deducted at the same time. Tell us about some points related to tax on FD:

- The bank does not deduct TDS on fixed deposits if your total income is less than Rs 2.5 lakh per annum. However, for this you will need to file Form 15G or 15H. In such situation, if you want to save TDS then definitely submit form 15G or 15H.

- If your interest income from the entire FD is less than Rs 40,000 per annum, then TDS is not deducted. Whereas if your interest income is more than Rs 40,000 then 10% TDS will be deducted. The bank can deduct 20% for not providing PAN card.

- This limit for deducting TDS on interest income of more than Rs 40,000 is for people below the age of 60. However, income up to Rs 50,000 from FDs of senior citizens above the age of 60 is exempt from tax. If the income is more than this, 10% TDS is deducted.

- If the bank has deducted TDS on the income from your FD interest and your total income does not come under the ambit of income tax, then you can claim the TDS deducted while filing taxes. It will be credited to your account.